If you have paid more taxes than your actual liability, you can request a refund for the excess amount. The Income Tax Department offers an online facility for tracking your Income tax refund status. You can easily check the progress of your refund by entering your PAN (Permanent Account Number) and the applicable Assessment Year.

- Tax refunds are initiated by the tax department once you have E-verified your return

- Typically, it takes 4-5 weeks for the refund to be deposited in your bank account

- If the refund is not received within this timeframe, you should consider these steps:

- Check intimation for any discrepancies or errors in your ITR (Login to e-filing portal > e-File > Income Tax Returns > View filed returns)

- Check your email for notifications from the Income Tax (IT) department regarding the status of the refund.

- Check the refund status using the methods provided below

How to Claim an Income Tax Refund?

To get your income tax refund or TDS refund, all you need to do is file your Income Tax Return and declare your income, deduction and tax paid details to the Income Tax Department. The amount of refund receivable is computed and shown in the tax return.

You have to finish e-filing to get your Income Tax Refund. Make sure to e-file this year to get your tax refund faster.

How to Calculate the Income tax Refund with Example?

If you paid more taxes than you were required to pay, you can claim the additional amount as an income tax refund.

Income Tax Refund = Taxes paid – Total tax liability

If the taxes paid (either by way of Advance Tax or TDS or TCS or Self-Assessment Tax) are more than the actual tax amount due, then the excess tax paid can be claimed as a refund. The income tax department will recompute the taxes and validate the refund claim before initiating the refund.

For example: Assume Mr. Gupta paid 3 lakh as an advance tax during the financial year. At the end of the financial year, he learns his tax liability is only 2 lakh. He can request a refund by filing an income tax return (ITR). If the assessing officer approves his request, the excess tax amount of 1 lakh will be credited to Mr Gupta’s pre-validated bank account.

3 lakh Advance Tax – 2 lakh Tax liability = 1 lakh Tax refund for Mr Gupta

How to Check your ITR Refund Status for AY 2024-25?

If you are concerned about your tax refund status, you can check the status of the income tax refund in three different ways, here are the methods listed below.

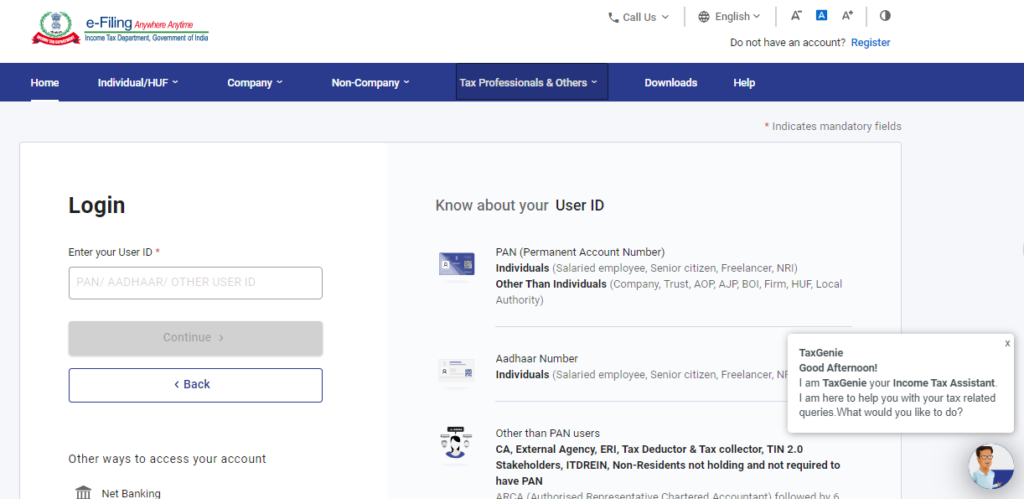

1. Through the Income Tax Portal

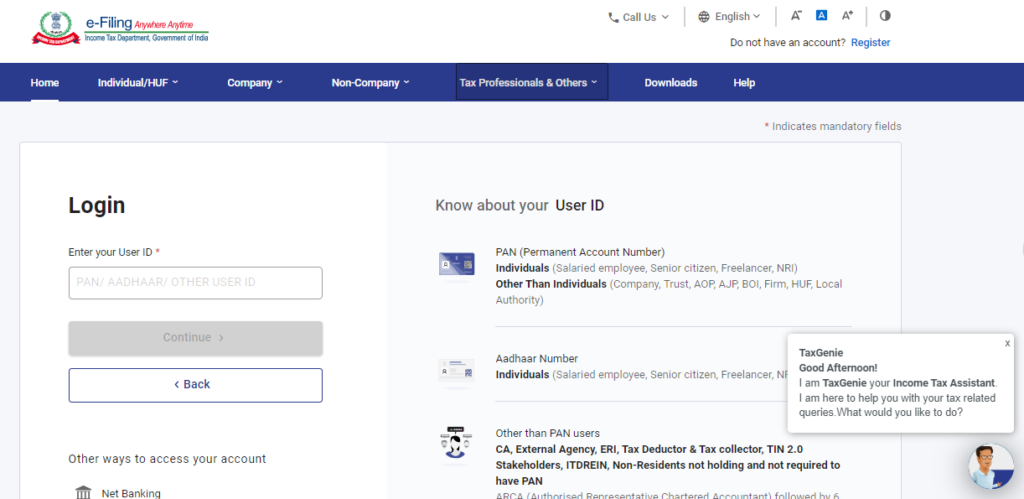

Step 1: Visit the income tax portal and log in to your account

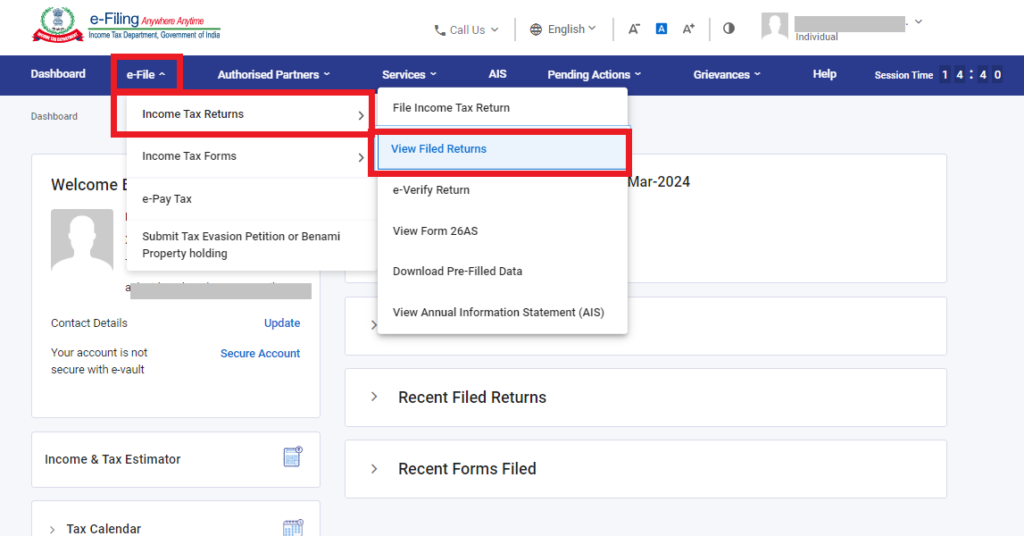

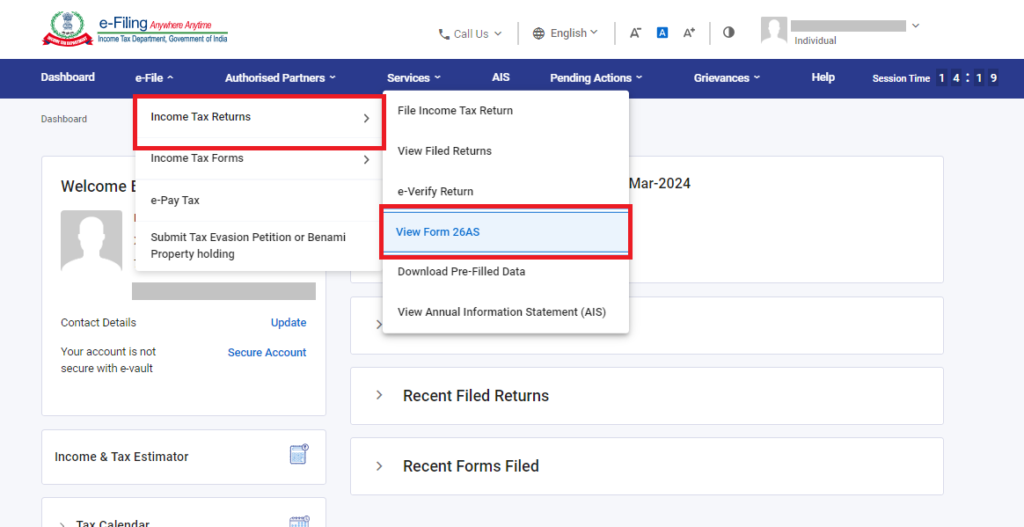

Step 2: Click on ‘e-File’, choose ‘Income Tax Returns’ and then select ‘View Filed Returns’

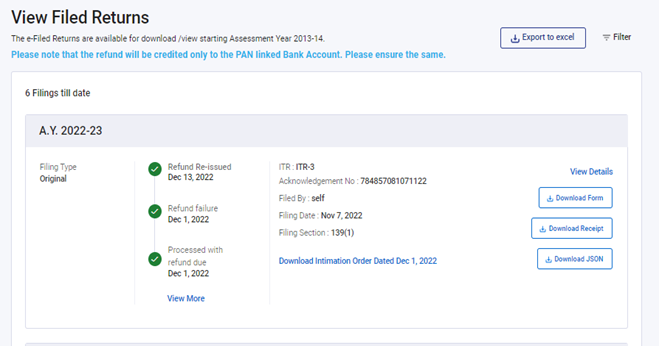

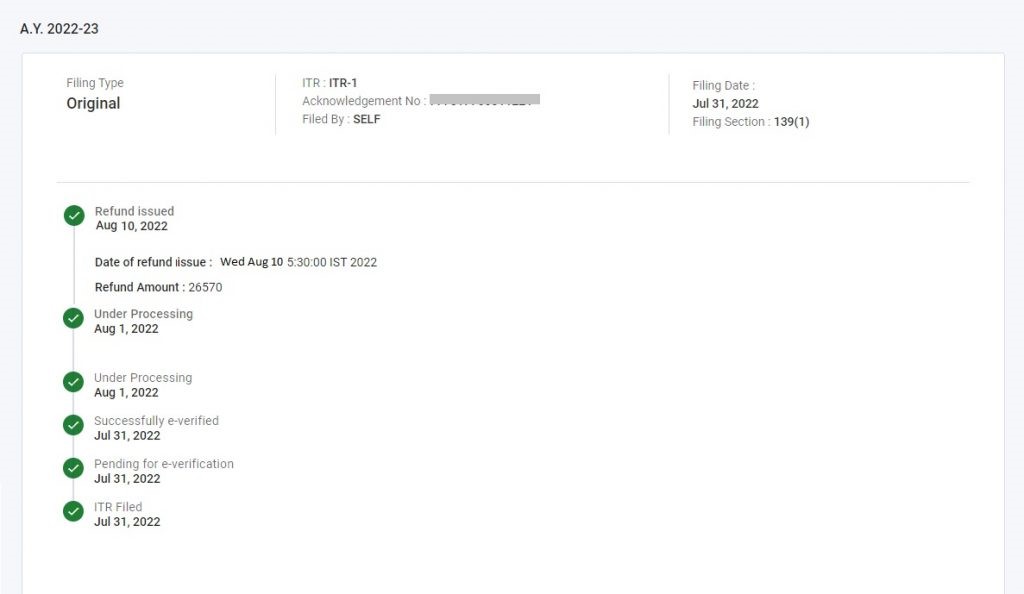

Step 3: You can see the status of your current and past income tax returns.

Step 4: Click on ‘View details,’ and you’ll see the status of your income tax refund, as shown in the picture below.

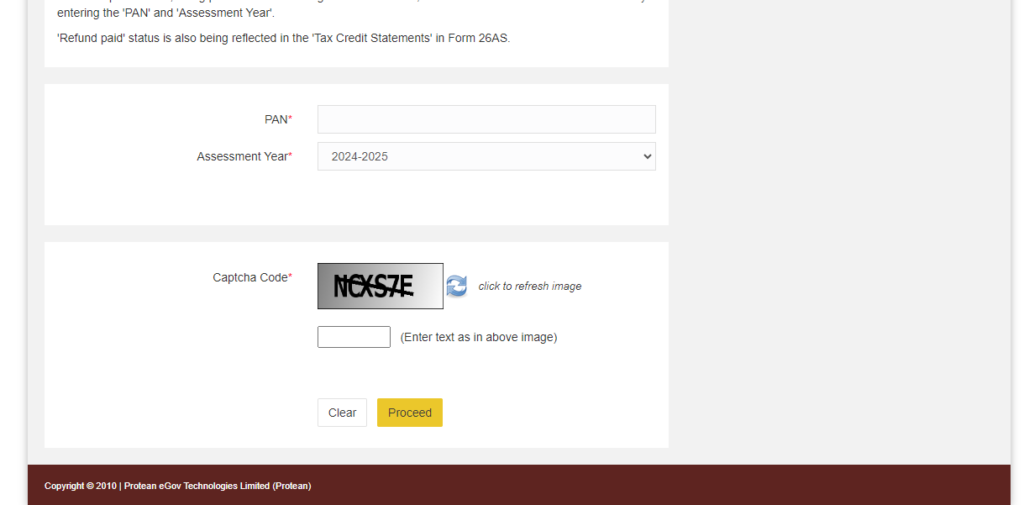

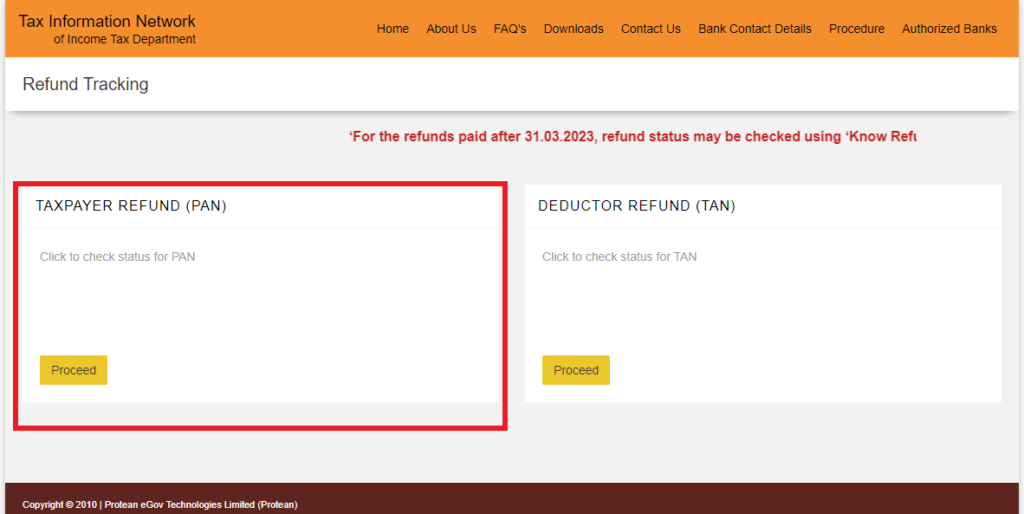

2. Through NSDL Portal

Step 1: Visit the NSDL Portal

Step 2: Enter your PAN details, select the Assessment Year from the drop-down option for which tax refund is awaited and enter the Captcha Code

Step 3: Click ‘Proceed’ under the ‘Taxpayer Refund (PAN)’ option

You will be directed to a page that displays the ‘Refund Status’.

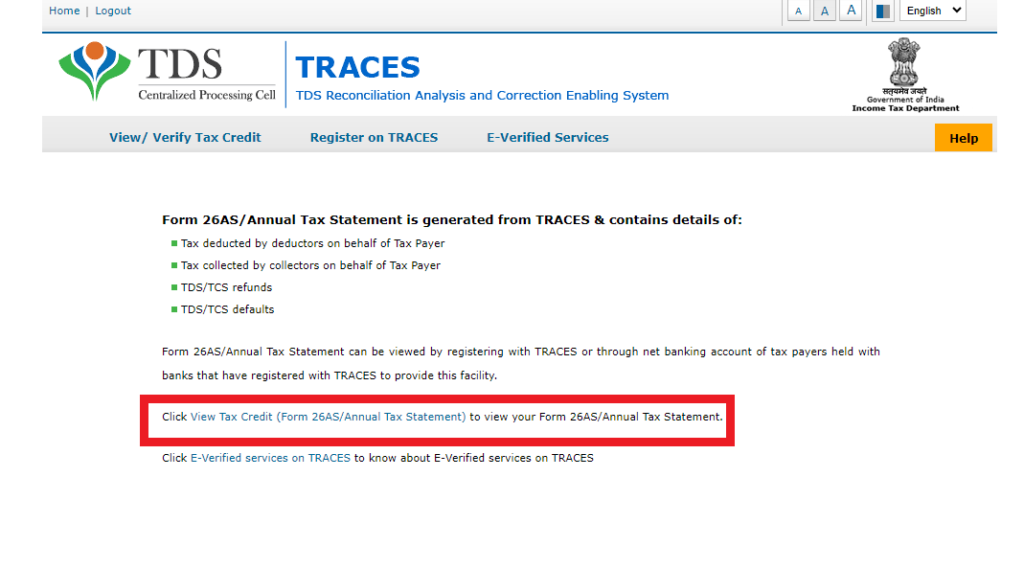

3. Through TRACES

Step 1: Log in to the income tax portal

Step 2: Click on ‘e-File’, select ‘Income Tax Returns’ and hit ‘View Form 26AS’

Step 3: You will be directed to the TDS Reconciliation Analysis and Correction Enabling System (TRACES) page, and Click on ‘View Tax Credit (Form 26AS/Annual tax statement) at the bottom of the page

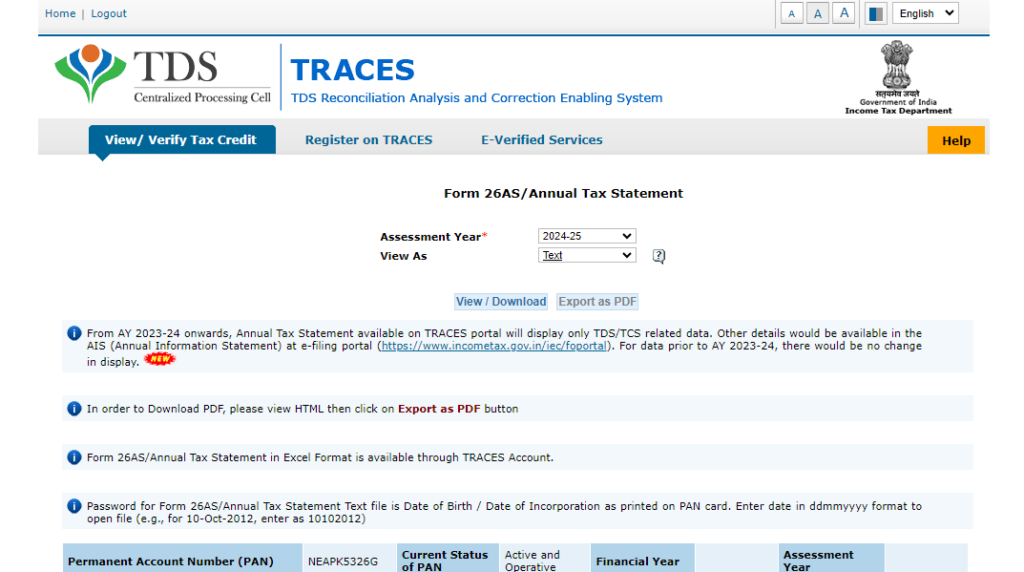

Step 4: Select the Assessment Year from the drop-down menu, and select view as ‘text’

You are directed to a page that displays the details of the paid refund

What does my Refund Status Mean?

Types Refund Statuses are as follows:

1. No E-filing has been done for Current AY

Step 1: What does this mean?

This could mean your IT return was not filed at all.

Step 2: What do I do now?

Double-check the Assessment Year that you checked your refund status for. Remember, Financial Year (FY) 2022-23 corresponds to Assessment Year (AY) 2023-24

2. Under Processing

What does this mean?

This means that the income tax department has still not processed your income tax return. Please check your refund status after a month to see if it has been updated.

3. Refund Issued

What does this mean?

This means the income tax department has sent the refund to you (by cheque or by direct debit to the bank account number you provided while e-filing).

4. Processed with No Demand No Refund

Step 1: What does this mean?

This could mean either:

- The most common case is you filed with no refund and no tax due. In that case, you’re all set for this year.

- It could also be that you did file for a refund, but the income tax department denied it because their calculations did not match yours.

This can generally happen because of a mismatch of TDS data or incomplete or improperly filled sections in the original filing.

Step 2: What do I do now?

If you forgot to include some deductions while filing, you can revise your return

- When the income tax department differs on the information you’ve provided, they would have also sent you an intimation u/s 143(1) explaining why. You can now fix the errors and file a rectification to support your refund claim.

- You can get help from an expert who can go through your tax notices and tax returns to best guide you. The expert can also help you file a rectification.

5. Refund Failure

Step 1: What does this mean?

This could mean the bank account details (account number or IFSC Code) that you submitted to the IT department are wrong and not pre-validated, and hence the refund wasn’t processed.

Step 2: What do I do now?

You need to log in to incometax.gov.in , enter the correct bank details with the IT department, and validate the bank details.

After you pre-validate the bank account, apply for the ‘Refund Reissue’ from your e-filing account.

6. Case Transferred to Assessing Officer

Step 1: What does this mean?

This could mean:

This typically indicates that the IT department needs further clarification/information regarding the income tax return that you filed. The Assessing Officer would like to discuss things further with you.

In some cases, this could also mean that you have some past taxes outstanding with the IT department which will be adjusted against the tax refund requested by you.

Step 2: What do I do now?

On receiving such a message, contact the AO (Jurisdictional Assessing Officer) for your region.

7. Demand determined

Step 1: What does this mean?

This means your refund request has been rejected, and in fact, the IT department finds that you owe them unpaid taxes instead.

You may also have received a notice from the income tax department stating the exact amount of tax outstanding and the reason for it.

This can happen because of incomplete or improper filing of tax details in the original return, withholding income information, or mismatch in TDS.

Step 2: What do I do now?

Read the intimation the IT department has sent you carefully and figure out where the problem occurred. Cross-check with your own e-filing records to verify the information you provided was accurate.

If you find that your own refund request was indeed erroneous, pay the tax demanded by the IT department within the time limit mentioned in the intimation.

If you think the IT department made a mistake, you can update your information if necessary and file a rectification supporting your refund claim.

We can connect you to an expert who can go through your tax notices and tax returns to best guide you. They can help you file a rectification.

8. Rectification Processed Refund Determined

What does this mean?

This message again goes out only to taxpayers who had been served an intimation to rectify their original returns. The rectified returns may be completely or partially accepted by the IT department.

Based on the rectification, the IT department has calculated the refund amount and credited the refund

Such a message is shortly followed by a revised intimation and the refund amount from the IT department.

9. Rectification Processed Demand Determined

What does this mean?

This message again goes out only to taxpayers who have been served an intimation to rectify their original returns. The IT department may completely or partially accept the rectified returns.

However, the IT Department maintains that you have outstanding unpaid taxes. You will also receive an intimation with the exact amount that is outstanding and will have to pay this off within 30 days of receipt.

10. Rectification Processed No Demand No Refund

What does this mean?

This message again goes out only to taxpayers who have been served an intimation to rectify their original returns. The IT department may completely or partially accept the rectified returns.

Based on the rectification, the department arrives at the conclusion that you neither owe any extra taxes nor do you qualify for any sort of refund of taxes already paid.

You will receive a revised intimation clarifying this fact.

We can connect you to a tax expert who can go through your tax notices and tax returns to best guide you. They can then help you file a rectification.

Is the Income Tax Refund Taxable?

No, the refund amount is not taxable. But, the interest received on the tax refund is taxable. The rate of tax on the interest would be as per your applicable tax slab rate.

Time Duration for a Tax Refund

The time taken to receive the income tax refund entirely depends on the Income Tax Department’s internal process. Generally, it takes around 7 to 120 days, with an average time of 90 days after you have e-verified your return. The Income Tax Department implemented a new refund processing system to enable faster refund processing with an expected turnaround of a few days instead of a few months.

Consistent with this objective, the average ITR processing duration has been reduced to 10 days for returns submitted in the AY 2023-24, as opposed to 82 days for returns submitted in the AY 2019-20 and 16 days for returns submitted in AY 2022-23.

Mode of Receiving the Refund

The Income Tax Department will send the refund amount through electronic mode (direct credit to the account) or through a ‘Refund Cheque’. You must enter the correct bank account number and IFSC code with complete address details, including the PIN code, at the time of filing your return to receive refunds. Refunds sent through cheques are dispatched to the address mentioned in the ITR through speed post.

Interest on Income Tax Refund

When the refund amount is more than 10% of the total tax payable for that particular year, you will receive a simple interest on the tax refund. Interest is computed at 6% per annum on the refund amount. The interest is computed from the beginning of the next financial year till the refund date.

Claiming Refund for Missed ITR Filing on Due Date

The deadline to file your ITR for non-audit cases was 31st July 2024. However, if you cannot manage to file your taxes before the deadline, you can still file a late return, known as Belated Return. The last date to file a belated return is 31st December 2024. You can claim your tax refund through a belated return.

You can contact the ‘Aaykar Sampark Kendra’ for any queries regarding income tax refunds. The toll-free helpline of the Aaykar Sampark Kendra Kendra is – 1800-180-1961. You can even send a mail with your refund query to refunds@incometax.gov.in.

For refund-related queries or modifications in the refund record processed at CPC Bangalore, you can contact – 1800-425-2229 or 080-43456700. For any payment-related query, contact the SBI Contact Centre toll-free number at -1800-425-9760.

Related Articles:

1. Tax Deductions under IT Unlock Hidden Tax Savings

2. Save Tax On New and Old Tax Regime for FY 2024-25

3. Difference Between IT Deductions and Exemptions

4. No Tax on Income Upto 7 Lakhs under New Regime

5. Income Tax Return Filing Due Dates for FY 2023-24

6. Common Mistakes to Avoid While filing 2023-24 ITR

7. Old vs New Tax Regime: Which Is Better ?